The State Department complains of how much work it is to handle a renunciation case. The fact that much of this work might in fact be self-inflicted seems to escape their grasp.

But the bureaucrats are short-sighted. A random dual-U.S./Canadian person might be more inclined to assert a relinquishment case to backdate the termination of citizenship. Note that the $2,350 fee only applies to people renouncing citizenship. It does not apply to people who have U.S. citizenship terminated by one of the other methods.

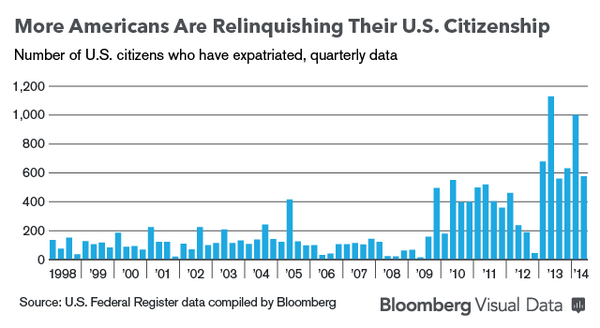

I predict that the State Department will have more renunciations occur because of this fee hike.

I also predict that the case load at the State Department to adjudicate mere “relinquishment” will increase. In fact, it will balloon. The State Department’s work load will get worse not better. And the State Department doesn’t charge a user fee for this work, so they will have to eat the entire amount of the overhead. Typical argument: “When I acquired Canadian citizenship in 19xx, I did so with the intention of giving up my U.S. citizenship and in fact I thought that was what happened automatically.” I’ve seen it succeed.

You’ve heard the phrase “Two heads are better than one”? Not always. Bureaucracy is an exercise in subtractive intelligence.

- 1. The IRS has still not published its Regulations interpreting Section 877A and Section 2801. Whenever the IRS puts something on paper, it is generally Very Bad for Carbon-Based Biped Life Forms. Get out before they write stricter rules.

- 2. Congress is full of it. Sooner or later the United States will start to control your ability to exit the country. When I travel, every other country tracks me going in and going out. When I leave the United States with my U.S. passport, I don’t get tracked . Sooner or later you will present your passport when you get on a plane to leave the USA. And when that happens, the IRS will be there to ensure you have paid up your taxes. Remember in 2012 when they tried to pass a law saying if the IRS thought that maybe you might owe $50,000 or more they could cancel your passport? Yeah. That.

- 3. Congress is full of it. Remember when the Facebook guy (Saverin) expatriated and Carl Schumer ranted? Yeah. More taxes on expatriates.

- 4. Congress is full of it. We still have on the books a mid-1990s law that says that expatriates can be barred from re-entry into the United States. Expect this to come up again.

It’s like the Chinese bullet fee.

The Cost of Cutting Ties with Uncle Sam Soar, Tim Harper, Toronto Star.

http://www.kentucky.com/2014/08/31/3405040_us-tax-system-driving-away-companies.html?rh=1

http://hodgen.com/blog/

Fatca

is controversial because it dramatically shifts the burden of

disclosure from the American person to their banks. Foreign financial

institutions are now more than just tax bounty hunters for the US

Internal Revenue Service (IRS), but pawns in an historical power play

for control over the global financial system.

Fatca

is controversial because it dramatically shifts the burden of

disclosure from the American person to their banks. Foreign financial

institutions are now more than just tax bounty hunters for the US

Internal Revenue Service (IRS), but pawns in an historical power play

for control over the global financial system.

https://www.paypal.com/au/webapps/mpp/irs-reporting-requirements:

As a result of recent changes to US legislation, PayPal has reporting obligations to the US tax authority, the Internal Revenue Service (IRS). We are required to identify customers with more than a certain transaction and payment volume and establish if they are US persons or entities subject to US taxes. Information about customers that are US persons or entities must then be provided to the IRS. PayPal Australia, along with all other US based payment processing companies (such as international banks), is required under this legislation to confirm whether account holders that meet the following criteria are US persons or entities subject to US taxes:

$20,000 USD in gross payment volume from sales of goods or services in a single calendar year AND

200 payments for goods or services in the same calendar year AND

Have made at least one withdrawal from their account in US dollars. PayPal will be asking customers approaching these levels to confirm if they are a US person or entity.