The

Obama administration’s ongoing coverup of the IRS scandal about

targeting the Tea Party is not the first instance of the federal

government persecuting the political Right with IRS audits. In fact, the

current IRS scandal — where Lois Lerner’s Blackberry and her desktop

computer have apparently been wiped clean to destroy evidence — are

actually following a more than 50-year script for government to destroy

the political Right in the form of the “Reuther Memorandum.” “The flow

of big money to the radical right should be dammed to the extent

possible,” the “Reuther Memorandum” informed the Kennedy administration,

asking for political assistance in stemming that flow. ...

Several

lessons can be learned from the 1960s. The first is that the

perseverance of The John Birch Society in the wake of such government

persecution and surveillance over the past 55 years should be a source

of hope for modern Tea Party organizations. The Obama administration has

tried to delay and deny tax-exempt status designations from the IRS in

order to starve the Tea Party for funds because they know most

corporations and foundations won’t donate to an organization without a

501(c)(3) or 501(c)(4) tax-exempt designation from the IRS. Despite the

intimidation, IRS harassment, and media ridicule, the JBS remains a

major fixture on the political Right today.

Secondly,

the experience of The John Birch Society teaches the lesson that

government can’t be trusted — even the administration of the allegedly

sainted and martyred John F. Kennedy — and its secrets need to be

revealed through dogged congressional investigations and strong public

information laws. Public information laws needed include a strengthened

Freedom of Information Act, as well as stronger whistleblower laws so

that public informants such as Edward Snowden can come to Congress with

information about blatant government violations of the U.S. Constitution

without fear of prosecution. Most of what we know about the FBI and IRS

persecution of political groups — both in the 1960s and under the Obama

administration — came from the congressional investigations and

whistleblowers who testified before them.

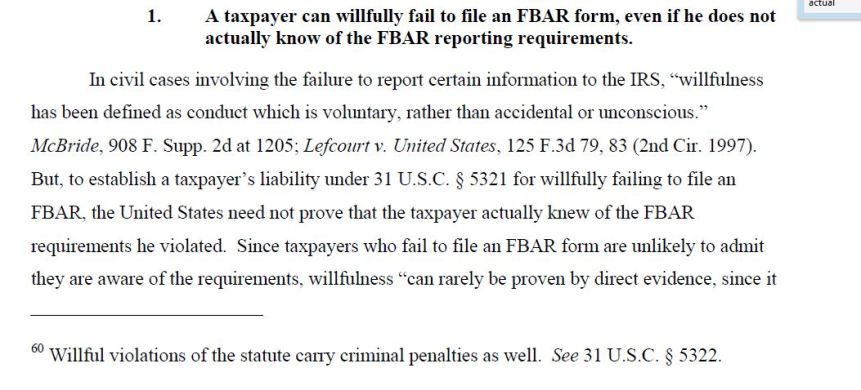

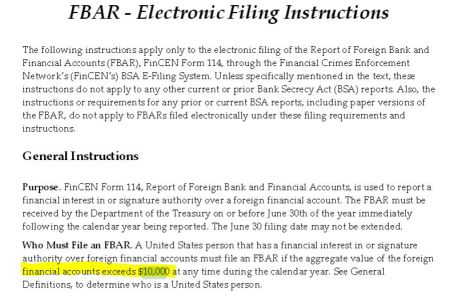

The relevant statute that requires reporting of a so-called foreign bank account report (“FBAR”) is

The relevant statute that requires reporting of a so-called foreign bank account report (“FBAR”) is