Ten Things to Know About the Taxpayer Advocate Service

1. The Taxpayer Advocate Service

(TAS) is an independent organization within the IRS and is your voice at the IRS.

2. We help taxpayers whose problems are causing financial difficulty. This includes businesses as well as individuals.

3. You may be eligible for our help if you’ve tried to resolve your tax problem through normal IRS channels and have gotten nowhere, or you believe an IRS procedure just isn’t working as it should.

4. The IRS has adopted a

Taxpayer Bill of Rights that includes 10 fundamental rights that every taxpayer has when interacting with the IRS:

Taxpayer Bill of Rights

- The Right to Be Informed.

- The Right to Quality Service.

- The Right to Pay No More than the Correct Amount of Tax.

- The Right to Challenge the IRS’s Position and Be Heard.

- The Right to Appeal an IRS Decision in an Independent Forum.

- The Right to Finality.

- The Right to Privacy.

- The Right to Confidentiality.

- The Right to Retain Representation.

- The Right to a Fair and Just Tax System.

Our TAS Tax Toolkit at

TaxpayerAdvocate.irs.gov can help you understand these rights and what they

mean for you. The toolkit also has examples that show how the Taxpayer Bill of Rights can apply in specific situations.

5. If you qualify for our help, you’ll be assigned to one advocate who will be with you at every turn. And our service is always free.

6. We have at least one local taxpayer advocate office in every state, the District of Columbia, and Puerto Rico. You can call your advocate, whose number is in your local directory, in Pub. 1546, Taxpayer Advocate Service — Your Voice at the IRS, and on our website at

irs.gov/advocate. You can also call us toll-free at

877-777-4778.

7. The TAS Tax Toolkit at

TaxpayerAdvocate.irs.gov has basic tax information, details about tax credits (for individuals and businesses), and much more.

8. TAS also handles large-scale or systemic problems that affect many taxpayers. If you know of one of these broad issues, please report it to us at

www.irs.gov/sams.

9. You can get updates at

10. TAS is here to help you, because when you’re dealing with a tax problem, the worst thing you can do is to do nothing at all.

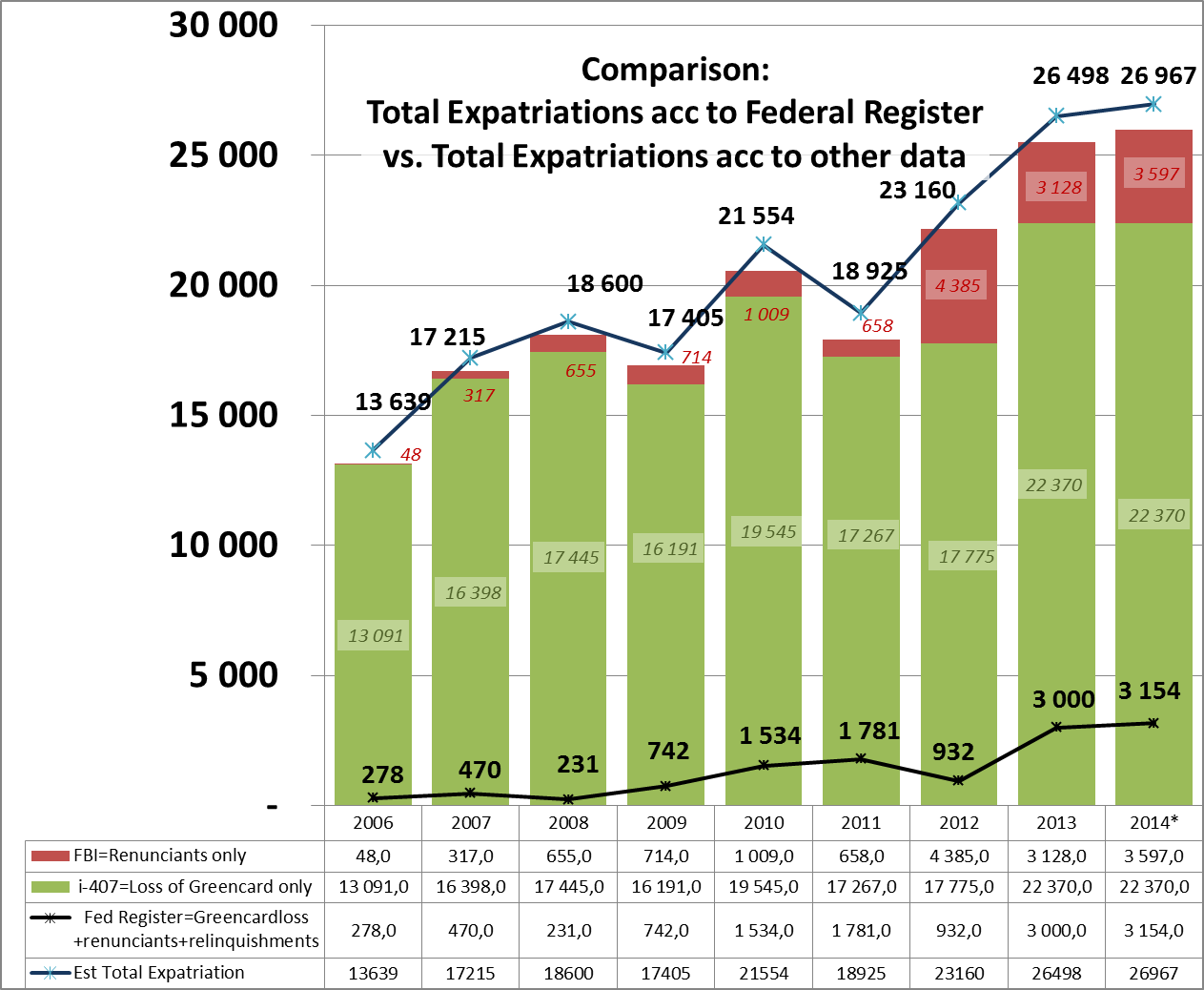

What would an ex-pat pensioner do if the US freezes an overseas bank account on simply a hunch she may have evaded taxes?

The US must be made to realise its tax border ends at its border.