The relevant statute that requires reporting of a so-called foreign bank account report (“FBAR”) is Section 5314 of Title 31 . This is not a federal tax law provision from Title 26 (aka I.R.C. aka Internal Revenue Code.)

The relevant statute that requires reporting of a so-called foreign bank account report (“FBAR”) is Section 5314 of Title 31 . This is not a federal tax law provision from Title 26 (aka I.R.C. aka Internal Revenue Code.)There have not been extensive revisions to this Section 5314 over the years and it remains largely as originally drafted and passed in the year 1970.

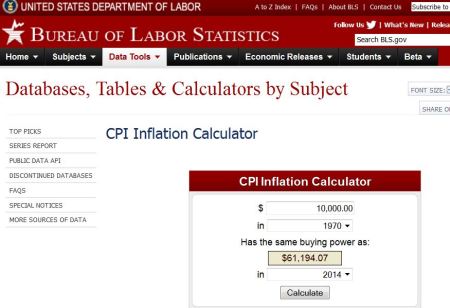

See, Currency and Foreign Transaction Reporting Act of 1970, P.L. No. 91-508, 84 Stat. 114 (1970).

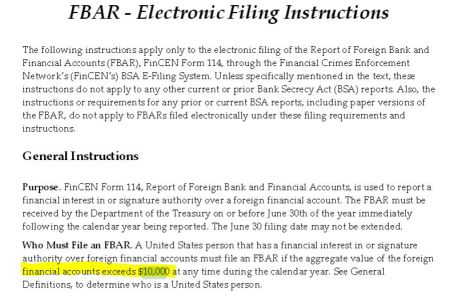

Curiously, the US$10,000 threshold amount is not reflected in the statutory language, nor in the regulations. Instead, this US$10,000 threshold is set forth in the instructions of the form. See page 4 of the FBAR electronic filing instructions.

The point of this post is twofold:

(1) the US$10,000 threshold amount is not part of the statutory or regulatory law; but rather is adopted in the instructions.

(2) US$10,000 in the year 1970 currently equals US$61,194 in inflation adjusted dollars (pursuant to the federal government’s CPI inflation calculator) which is a far different threshold for reporting

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.