As far as I know no comprehensive effort has ever been undertaken to determine the total revenue impact of CBT, including revenue lost to the tremendous disincentives and opportunity costs it imposes upon American businessmen. The argument put forth for CBT is that all Americans should be taxed the same, yet the multiple instances of double taxation of Americans abroad demonstrate exactly the opposite. The fundamental justification for taxation is that it funds taxpayer services. CBT contradicts this principle, as the pension, healthcare, education, and infrastructure costs that overseas Americans engender are paid for by foreign governments and the taxpayers themselves. Conversely, the imposition of a "sui generis" extraterritorial tax regime manifests a decision on the part of the US to unilaterally grant itself the right to extract from the economy of every other country a scarce and strategic economic source : cash.

Even tough the US recognizes the first right of taxation to be with the country of residence, CBT systematically penalizes Americans abroad. It does not take into consideration the total tax burden imposed on individuals by their country of residence (SS, net wealth and indirect taxes like VAT, excise taxes etc...) . Would it be such a stupid idea if we change the current CBT (citizenship based taxation) into a fee based system for the approx. 7 million expats who live and work outside the US.

How about an annual fee of $100 per USP and only the duty to file a NRA tax return if and when US sourced income exists. This would be a win-win situation for everybody. This would save the IRS and Treasury 90% of their current compliance budget with regards to FEIE and FTC audits and tax return processings BUT it would generate imediatedly a revenue stream of $700,000,000 annually (7mio X $100) with little cost associated .

On the other side the approx. 7 mio expats would not have to spend $1,2 or 3,000 annually on tax preparation fees and would not need a CPA or tax lawyer anymore and more importantly could use and benefit from the tax system (retirement planing) of their current country of residence.

For the most effective use of this blog and the links, readers must have the background and skills to test the information by further research and analysis before reaching any conclusion as to its usefulness and correctness in actual situations. Legal advice is always individual, considering the unique facts and circumstances of each client and shaping legal advice and strategies for the particular client. That simply cannot happen on this blog.

Sunday, November 30, 2014

No wonder that CBT is here to stay ... a conversation with Jack Townsend - a tax lawyer and professor who teaches some University of Houston Tax Fraud Classes

There is a very strong disconnect between how Americans -even the ones that have the intelligence and experience to know better- in the homeland think

are the rights and responsibilities of a U.S. citizen abroad and the reality !

I can't think of one person I've talked to in the homeland who wasn't 100%

convinced that the Marines would show up to help him if he and other Americans

got into trouble outside the U.S.

The fee business really sets them back on their heels - they had no idea. And once they've wrapped their minds around how it really works, I sometimes get this response, "It's not the problem of the US government if you go gallivanting off to dangerous places and it shouldn't be their responsibility to bail you out." Okey-dokey. Fair enough. Nice to know we are on our own. But then everyone needs to stop using this as an argument for why expats should be paying taxes twice. Winston Churchill once said "A country which tries to tax itself out of debt is like a man standing in a bucket and trying to lift himself up by the handles." Take a look at the following conversation with Jack Townsend of Townsend & Jones, L.L.P

The fee business really sets them back on their heels - they had no idea. And once they've wrapped their minds around how it really works, I sometimes get this response, "It's not the problem of the US government if you go gallivanting off to dangerous places and it shouldn't be their responsibility to bail you out." Okey-dokey. Fair enough. Nice to know we are on our own. But then everyone needs to stop using this as an argument for why expats should be paying taxes twice. Winston Churchill once said "A country which tries to tax itself out of debt is like a man standing in a bucket and trying to lift himself up by the handles." Take a look at the following conversation with Jack Townsend of Townsend & Jones, L.L.P

FATCA....the threat of forcing many Americans out of the shadows and into the offices of accountants licensed to do U.S. taxes.

As we know these so called "sweeping laws" have many consequences. Their impact is inevitably more far-reaching than lawmakers imagine. They snare the unwitting, and inflict often heavy collateral damage. FATCA is aimed at finding unreported income by taking a peek at virtually every account held by U.S. citizens, anywhere in the world. It’s like dragging a massive net along the ocean floor to catch a handful of shrimp.

With demand brisk and supply of experts limited, some individuals report being charged as much as $4,000 a year to do relatively straightforward U.S. taxes – filings that would typically cost less than $1,000 in the United States. An individual who hasn’t filed for years can easily face tens of thousands of dollars in accounting fees to "come clean" (whatever that is supposed to mean), even if they owe no U.S. taxes.

Given that roughly 7 million Americans live outside the United States, FATCA is an accountant’s wet dream.

With demand brisk and supply of experts limited, some individuals report being charged as much as $4,000 a year to do relatively straightforward U.S. taxes – filings that would typically cost less than $1,000 in the United States. An individual who hasn’t filed for years can easily face tens of thousands of dollars in accounting fees to "come clean" (whatever that is supposed to mean), even if they owe no U.S. taxes.

Given that roughly 7 million Americans live outside the United States, FATCA is an accountant’s wet dream.

What individuals are U.S. taxpayers? Who is a U.S. citizen?

There are individuals that the U.S. government would define as “U.S. citizens” who:

There are individuals that the U.S. government would define as “U.S. citizens” who:

- do NOT agree that they are U.S. citizens because they have performed a “relinquishing act” under applicable U.S. laws;

- do NOT even know that they may be U.S. citizens because they have never lived in the United States

- are citizens and residents of countries that do NOT allow multiple citizenships

To put it another way: one’s status as a U.S. citizen is NOT always clear.

Friday, November 28, 2014

As Bruce Springsteen would say, that’s the result of being “Born In The USA”.........

One thing sticks out here and that is denial ....

Centuries ago France helped americans become independant to the english empire because they were fed up with paying 14% taxes on their income at the time to England....please explain to me what has changed or is different in 2014 ??

At the end of the day the only thing that people have and that countries have is their “moral capital”. The USA is rapidly eroding the “moral capital” that it has remaining.

Most Homeland Americans don’t believe that the USA would attempt to levy taxes on (1) somebody who doesn’t live in the USA on (2) income not earned in the USA. Most Homeland Americans would regard this as “unjust”.

They would regard it as “unjust” because Boris Johnson - the major of London like many others” doesn’t live in the USA and didn’t choose where he was born .

Finally, if Homeland Americans knew or understand how compliance with U.S. tax laws outside the U.S. destroyed people’s lives (i’ts really a form of “Life Control”), they would regard it is inhumane.

Yes, what the U.S. calls “citizenship-based taxation” (making it sound patriotic and reasonable) is actually “place of birth or naturalization taxation”. As Bruce Springsteen would say, that’s the result of being “Born In The USA”.

In fact for those who were “Born In The USA” but who live outside the USA, US tax policies are:

“Unjust, they are inhumane, people didn’t choose where they were born.”

That’s the America of today. Does America care? No.

Does America care that it doesn’t care? No. (and this is the real moral crisis.)

In any event, FATCA is being used by the USA to enforce US extra-territorial taxation outside the borders of the USA. Taxation of “non-US income” on people who “don’t live in the US”, assumes that the USA has a “property right” in people. Why? Well, because they were born on U.S. soil. ? …. This is a moral issue.

It’s really very simple: citizenship-based taxation is America’s Apartheid system. It is repugnant, immoral and indefensible. Since CBT is so clearly irredeemable, there is really nothing to talk about, unless your intellectual curiosity exists in a profoundly amoral vacuum.

CBT discriminates against a particular group of people on the basis of their place of birth – a characteristic as immutable as the colour of their skin. It labels them, tracks them, intimidates them, criminalizes them and forces them into virtual prisons from which escape is nearly impossible. Worse, the architects of CBT are now co-opting the rest of the world to implement this discriminatory regime for them. It is astonishing and disheartening how quickly and easily this is unfolding.

Far too many countries, cowed by the 30% withholding stick that the U.S. threatens to beat them with, like the FBAR and OVDP sticks they already beat their CBT victims with, simply refuse to challenge America on fundamental moral grounds and it is wrong.

The U.S. does not deserve a free pass on CBT and FATCA any more than the old South African government deserved a free pass for its heinous apartheid policies. Yet several ostensibly modern and enlightened nations have rationalized their acquiescence to FATCA by publicly exclaiming that America has the inherent right to tax its citizens in whatever manner it chooses. Well, in a just world it does not, for CBT represents a clear denial of basic human rights and dignity.

Yes, the global hypocrisy is staggering, especially from countries like Canada. Last year, the Conservative government expelled the consul-general for Eritrea for that regime’s tax extortion efforts against its expats in Canada. Just last week, the same government enthusiastically ushered-in America’s FATCA laws to override our country’s own Charter of rights and freedoms, discriminating on the basis of national origin, gutting federal banking privacy laws and setting the stage for a massive legal challenge which will be fought in the Supreme Court.

Beneath all the technocratic language about forms, compliance, jurisdictions and enforcement, there is a fundamental truth: these American policies are morally unjust and the world must not condone them any longer. FATCA will be a global disaster unless it is stopped now.

It is indeed time for the world to say no to the U.S. practice of citizenship-based taxation and to force it to adopt residency-based taxation like the rest of the world. If not, then the world better find a more deserving reserve currency in a hurry – the United States has abused its position of trust for far too long and it needs to be reminded that it is just one nation in a community of nations. The breathtaking audacity of FATCA is simply a bridge too far.”

For America the attempt to impose taxation on people who don’t reside in the USA because they were “Born In The USA” is evidence of an aspect of “moral bankruptcy”.

The America of today is:

- Financially bankrupt

- Spiritually bankrupt

- Morally bankrupt

And ….

It doesn’t care that it doesn’t care!

Both the USA and South Africa have punitive (as did the Nazis and the Soviets) Exit Taxes. But there is one way that the USA’s Exit Tax is different.Whereas South Africa (and the other two countries I mentioned) imposed Exit Taxes when people physically left the country, the USA imposes an Exit Tax if one renounces US citizenship regardless of whether one physically leaves the USA or not. Think of it:

The USA imposes an “Exit Tax” on many middle class people who do not live in the USA if they don’t want to be an American citizen anymore!

Centuries ago France helped americans become independant to the english empire because they were fed up with paying 14% taxes on their income at the time to England....please explain to me what has changed or is different in 2014 ??

At the end of the day the only thing that people have and that countries have is their “moral capital”. The USA is rapidly eroding the “moral capital” that it has remaining.

Most Homeland Americans don’t believe that the USA would attempt to levy taxes on (1) somebody who doesn’t live in the USA on (2) income not earned in the USA. Most Homeland Americans would regard this as “unjust”.

They would regard it as “unjust” because Boris Johnson - the major of London like many others” doesn’t live in the USA and didn’t choose where he was born .

Finally, if Homeland Americans knew or understand how compliance with U.S. tax laws outside the U.S. destroyed people’s lives (i’ts really a form of “Life Control”), they would regard it is inhumane.

Yes, what the U.S. calls “citizenship-based taxation” (making it sound patriotic and reasonable) is actually “place of birth or naturalization taxation”. As Bruce Springsteen would say, that’s the result of being “Born In The USA”.

In fact for those who were “Born In The USA” but who live outside the USA, US tax policies are:

“Unjust, they are inhumane, people didn’t choose where they were born.”

That’s the America of today. Does America care? No.

Does America care that it doesn’t care? No. (and this is the real moral crisis.)

In any event, FATCA is being used by the USA to enforce US extra-territorial taxation outside the borders of the USA. Taxation of “non-US income” on people who “don’t live in the US”, assumes that the USA has a “property right” in people. Why? Well, because they were born on U.S. soil. ? …. This is a moral issue.

It’s really very simple: citizenship-based taxation is America’s Apartheid system. It is repugnant, immoral and indefensible. Since CBT is so clearly irredeemable, there is really nothing to talk about, unless your intellectual curiosity exists in a profoundly amoral vacuum.

CBT discriminates against a particular group of people on the basis of their place of birth – a characteristic as immutable as the colour of their skin. It labels them, tracks them, intimidates them, criminalizes them and forces them into virtual prisons from which escape is nearly impossible. Worse, the architects of CBT are now co-opting the rest of the world to implement this discriminatory regime for them. It is astonishing and disheartening how quickly and easily this is unfolding.

Far too many countries, cowed by the 30% withholding stick that the U.S. threatens to beat them with, like the FBAR and OVDP sticks they already beat their CBT victims with, simply refuse to challenge America on fundamental moral grounds and it is wrong.

The U.S. does not deserve a free pass on CBT and FATCA any more than the old South African government deserved a free pass for its heinous apartheid policies. Yet several ostensibly modern and enlightened nations have rationalized their acquiescence to FATCA by publicly exclaiming that America has the inherent right to tax its citizens in whatever manner it chooses. Well, in a just world it does not, for CBT represents a clear denial of basic human rights and dignity.

Yes, the global hypocrisy is staggering, especially from countries like Canada. Last year, the Conservative government expelled the consul-general for Eritrea for that regime’s tax extortion efforts against its expats in Canada. Just last week, the same government enthusiastically ushered-in America’s FATCA laws to override our country’s own Charter of rights and freedoms, discriminating on the basis of national origin, gutting federal banking privacy laws and setting the stage for a massive legal challenge which will be fought in the Supreme Court.

Beneath all the technocratic language about forms, compliance, jurisdictions and enforcement, there is a fundamental truth: these American policies are morally unjust and the world must not condone them any longer. FATCA will be a global disaster unless it is stopped now.

It is indeed time for the world to say no to the U.S. practice of citizenship-based taxation and to force it to adopt residency-based taxation like the rest of the world. If not, then the world better find a more deserving reserve currency in a hurry – the United States has abused its position of trust for far too long and it needs to be reminded that it is just one nation in a community of nations. The breathtaking audacity of FATCA is simply a bridge too far.”

For America the attempt to impose taxation on people who don’t reside in the USA because they were “Born In The USA” is evidence of an aspect of “moral bankruptcy”.

The America of today is:

- Financially bankrupt

- Spiritually bankrupt

- Morally bankrupt

And ….

It doesn’t care that it doesn’t care!

Both the USA and South Africa have punitive (as did the Nazis and the Soviets) Exit Taxes. But there is one way that the USA’s Exit Tax is different.Whereas South Africa (and the other two countries I mentioned) imposed Exit Taxes when people physically left the country, the USA imposes an Exit Tax if one renounces US citizenship regardless of whether one physically leaves the USA or not. Think of it:

The USA imposes an “Exit Tax” on many middle class people who do not live in the USA if they don’t want to be an American citizen anymore!

Wednesday, November 26, 2014

The IRS Scandal, Day 566

In

a shocking revelation, the Treasury Inspector General has identified

some 2,500 documents that “potentially” show taxpayer information held

by the Internal Revenue Service being shared with President Obama’s

White House.

The discovery was revealed to the group Cause of Action, which has sued for access to any of the documents. It charges that the IRS and White House have harassed taxpayers.

In

an email from the Justice Department’s tax office, an official revealed

the high number of documents, suggesting that the White House was hip

deep in probes of taxpayers, likely including conservatives and Tea

Party groups associated with the IRS scandal.

Tuesday, November 25, 2014

Meanwhile a class of taxpayers that you would think should be nailed pretty easily defrauds the IRS to a tune of $1bn a year.

Tax refund fraud associated with prisoner Social Security Numbers

remains a significant problem for tax administration, according to a

report by the Treasury Inspector General for Tax Administration (TIGTA).

TIGTA's report is the third in a series of audits it has conducted since 2010 that have documented alarming growth in prisoner tax refund fraud. The number of fraudulent tax returns filed using a prisoner's Social Security Number that were identified by the Internal Revenue Service (IRS) increased from approximately 37,000 tax returns in Calendar Year 2007 to more than 137,000 tax returns in Calendar Year 2012. The refunds claimed on these tax returns increased from $166 million to $1 billion.

TIGTA's report is the third in a series of audits it has conducted since 2010 that have documented alarming growth in prisoner tax refund fraud. The number of fraudulent tax returns filed using a prisoner's Social Security Number that were identified by the Internal Revenue Service (IRS) increased from approximately 37,000 tax returns in Calendar Year 2007 to more than 137,000 tax returns in Calendar Year 2012. The refunds claimed on these tax returns increased from $166 million to $1 billion.

Compliance is a form of taxation...double compliance, therefore double taxation.

Boris Johnson pays all his UK taxes, but the US wants to tax him

more for taxes the UK does not have. He pays tax once to England on

income but then the US wants to tax that same income in a different way

and then it becomes double taxation.

This broad definition of double taxation is much more realistic than the narrow Treasury department definition that works something like this: The US has a new Net Investment Income Tax. Some call it Obamacare tax. If you are in the income leagues of Boris Johnson and even considerably lower you may attract this. Here is how it is not double taxation according to the Treasury Department definition: The US has this 3.8% tax (would not apply to Boris Johnson’s home sale in 2009 as that was before the introduction of the tax), and the UK does not have a Net Investment Income Tax/Obamacare Tax. Therefore the US rate of 3.8% flows on top of all other taxes in full and is not double taxation because the income is not subject to a UK Net Investment Income Tax. This is an example of how the tax treaties the US defined “prevents” double taxation. The reality: the taxes flow straight on top and according to the tax treaty there would be no credit allowed for the US tax paid on Net Investment Income Tax for UK source investments against UK tax liabilities.

Maybe another way to think of it is if there is no credit for US taxes paid against UK taxes for UK source assets/income for those tax resident in the UK then it is double taxation.

The whole tax situation is very complex. There are many including it may appear most politicians who when they hear “tax” they shut down and do not want to comprehend any further. Then when there are two tax systems overlayed on each each other it gets more unfathomable. This is part of the reason politicians around the world have been duped by the treaty language of “preventing double taxation” and think helicopter view – prevents double taxation great, I’ll vote for it! Yet not preventing double taxation for those impacted.

Whether Boris complies or not, his action (or inaction) would be a reasonable response to a law imposed on him by an immoral nation. Whichever route he takes, he’ll be accused of not acting with moral guidance.

This broad definition of double taxation is much more realistic than the narrow Treasury department definition that works something like this: The US has a new Net Investment Income Tax. Some call it Obamacare tax. If you are in the income leagues of Boris Johnson and even considerably lower you may attract this. Here is how it is not double taxation according to the Treasury Department definition: The US has this 3.8% tax (would not apply to Boris Johnson’s home sale in 2009 as that was before the introduction of the tax), and the UK does not have a Net Investment Income Tax/Obamacare Tax. Therefore the US rate of 3.8% flows on top of all other taxes in full and is not double taxation because the income is not subject to a UK Net Investment Income Tax. This is an example of how the tax treaties the US defined “prevents” double taxation. The reality: the taxes flow straight on top and according to the tax treaty there would be no credit allowed for the US tax paid on Net Investment Income Tax for UK source investments against UK tax liabilities.

Maybe another way to think of it is if there is no credit for US taxes paid against UK taxes for UK source assets/income for those tax resident in the UK then it is double taxation.

The whole tax situation is very complex. There are many including it may appear most politicians who when they hear “tax” they shut down and do not want to comprehend any further. Then when there are two tax systems overlayed on each each other it gets more unfathomable. This is part of the reason politicians around the world have been duped by the treaty language of “preventing double taxation” and think helicopter view – prevents double taxation great, I’ll vote for it! Yet not preventing double taxation for those impacted.

Whether Boris complies or not, his action (or inaction) would be a reasonable response to a law imposed on him by an immoral nation. Whichever route he takes, he’ll be accused of not acting with moral guidance.

Green card abandonment and treaty election overlap question

A long-term U.S. resident, who is a U.K. citizen and in not a U.S. citizen, plans to deliver his "green card" - along with Form I-407 - to the U.S. Embassy in London on January 4, 2016. January 1, 2016 is a Friday so Monday, January 4, 2016 is the first business day for the embassy in 2016. His expatriation date would, therefore be January 4, 2016 and he would file a dual-status return for 2016.

However, if the taxpayer files a Forms 1040NR for 2016 with an election under the US-UK income tax treaty to be treated as a U.K. resident, the election would be retroactive to January 1, 2016 and a dual-status return would not be required.Is the expatriation date January 1, 2016 under the Form 1040NR treaty election rather than January 4, 2016 based on the delivery date of the "green card" to the U.S. Embassy in London?

The

short answer is that January 1, 2016 is the first day of the rest

of your client’s life. You do not prepare a dual status tax return for

2016.

Monday, November 24, 2014

Don’t forget, even children must file the so-called FBAR and Form 8938 if it is required!

New FBAR instructions

were added on June 11 2014 to emphasize this. The filing requirement

for minors is clarified on Page 6 by adding the following text:

Responsibility for Child’s FBAR

Generally, a child is responsible for filing his or her own FBAR report. If a child cannot file his or her own FBAR for any reason, such as age, the child’s parent, guardian, or other legally responsible person must file it for the child.

Signing the child’s FBAR

If the child cannot sign his or her FBAR, a parent or guardian must electronically sign the child’s FBAR. In item 45 Filer Title enter “Parent/Guardian filing for child”

Also if certain monetary thresholds are met and the child is required to file a tax return, the child may also be required to file Form 8938 – Statement of Specified Foreign Financial Assets. This Form is completely separate and distinct from the FBAR. It is not replaced by the FBAR.

Responsibility for Child’s FBAR

Generally, a child is responsible for filing his or her own FBAR report. If a child cannot file his or her own FBAR for any reason, such as age, the child’s parent, guardian, or other legally responsible person must file it for the child.

Signing the child’s FBAR

If the child cannot sign his or her FBAR, a parent or guardian must electronically sign the child’s FBAR. In item 45 Filer Title enter “Parent/Guardian filing for child”

Also if certain monetary thresholds are met and the child is required to file a tax return, the child may also be required to file Form 8938 – Statement of Specified Foreign Financial Assets. This Form is completely separate and distinct from the FBAR. It is not replaced by the FBAR.

Dreams of Compliance Condors or the “Wonderful World of Forms, Threats and Penalties”

Form People (also known as "compliance condors" or "compliance vultures") are mostly honest and hardworking, but they live in a special world -- a world in which forms are sacred. This is completely normal from the perspective of the Compliance Condor unfortunately they lack perspective.

In fact, for most of them, the completion of forms or the act of formication is the fundamental

obligation of citizenship (or at least U.S. citizenship). Furthermore,

very few of them see the system of taxes, forms as penalties as being

immoral. They just see it as normal.

One could say that the Compliance Condors work “within the system”. But, the truth is that the Compliance Condors “Are The System”. They make it work. They shape the law. They shape the expectation of the law. Once one Condor begins filing a specific form (example 3520 for the TFSA) the other Condors are sure to follow. Because Condors are “Inside The Form” looking only at the Form, they can’t imagine what it means to be “Outside The Form” looking in. They can’t see the immorality, the injustice, the waste of human resource and the dehumanizing of the individual. In fact the Compliance Condors “aid and abet” each of these things – they take pride in doing it. But, there’s much more.

In the “Form Industry” there is a hierarchy of forms. Those who are most experienced assist with the most complex forms. Imagine the day in the life of a Compliance Condor when he/she reaches the point where he is assigned a 5471 or an 8621. After all, those who are most junior would start with an FBAR or perhaps a schedule B. The value of a Compliance Condor is a function of the forms to which he is entrusted. His sense of “self worth” is defined by the form that he is assigned.

A Compliance Condor would start the day by looking in the mirror and saying:

“In forms we trust”.

The most dedicated Condors dream of Forms. But, they do more than dream about Forms. Because their identity is a function of their forms, many of them go further than dreaming about forms. Those who are most dedicated actually dream about being specific line numbers on different forms . In social settings they confide about their dreams to other Condors. In the industry, these are known as “Form Dreams” .

So, yes when the Compliance Condors write about FATCA, FBAR and other sacred instruments of confiscation, they are being sincere. They believe they are being helpful. They are NOT being dishonest and above all else, they are simply writing about the world they way they see it and the way they experience it.

And that Dr. Reader is exactly the problem!

P.S. Avoid “Form Crime” – The Compliance Condors will love you!

One could say that the Compliance Condors work “within the system”. But, the truth is that the Compliance Condors “Are The System”. They make it work. They shape the law. They shape the expectation of the law. Once one Condor begins filing a specific form (example 3520 for the TFSA) the other Condors are sure to follow. Because Condors are “Inside The Form” looking only at the Form, they can’t imagine what it means to be “Outside The Form” looking in. They can’t see the immorality, the injustice, the waste of human resource and the dehumanizing of the individual. In fact the Compliance Condors “aid and abet” each of these things – they take pride in doing it. But, there’s much more.

In the “Form Industry” there is a hierarchy of forms. Those who are most experienced assist with the most complex forms. Imagine the day in the life of a Compliance Condor when he/she reaches the point where he is assigned a 5471 or an 8621. After all, those who are most junior would start with an FBAR or perhaps a schedule B. The value of a Compliance Condor is a function of the forms to which he is entrusted. His sense of “self worth” is defined by the form that he is assigned.

A Compliance Condor would start the day by looking in the mirror and saying:

“In forms we trust”.

The most dedicated Condors dream of Forms. But, they do more than dream about Forms. Because their identity is a function of their forms, many of them go further than dreaming about forms. Those who are most dedicated actually dream about being specific line numbers on different forms . In social settings they confide about their dreams to other Condors. In the industry, these are known as “Form Dreams” .

So, yes when the Compliance Condors write about FATCA, FBAR and other sacred instruments of confiscation, they are being sincere. They believe they are being helpful. They are NOT being dishonest and above all else, they are simply writing about the world they way they see it and the way they experience it.

And that Dr. Reader is exactly the problem!

P.S. Avoid “Form Crime” – The Compliance Condors will love you!

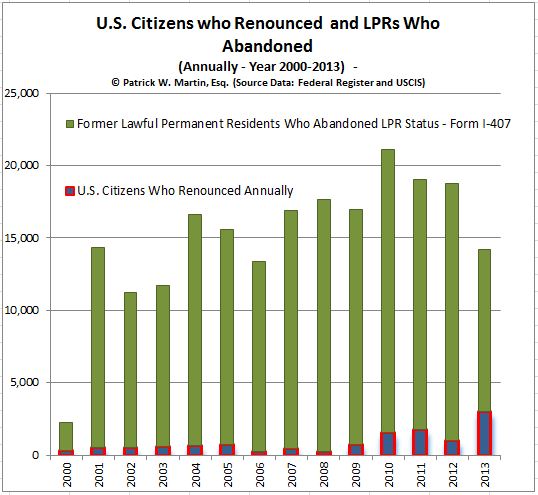

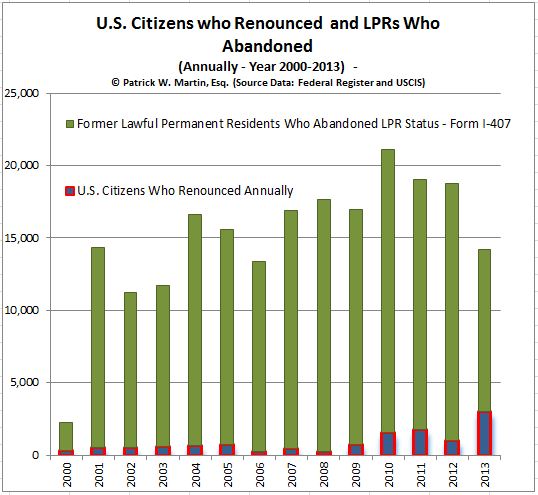

U.S. citizenship renunciation-relinquishment and lawful permanent residency abandonment.

There has not been any detailed discussion of the number of LPRs who

leave the U.S. annually. The data provided by the U.S. Citizenship and

Immigration Services reflects about 16 times more LPRs formally abandon

their lawful permanent residency status by filing Form I-407 compared to

U.S. citizens who renounce. The chart here shows a comparison for the

years 2000 through 5/2013 of the total (i) USCs who have renounced

compared to (ii) LPRs who have formally abandoned that status.

http://www.dhs.gov/sites/default/files/publications/ois_lpr_pe_2012.pdf

http://www.dhs.gov/sites/default/files/publications/ois_lpr_pe_2012.pdf

Boris Johnson, accidental American, says he will NOT pay the US tax on the sale of his home in the UK!

Until the US comes to value it’s citizens abroad, no gesture in the world is going to make an iota of difference. I believe for expats, big change is not quite ripe for happening. More people need to renounce. BoJo’s rebellion would certainly help, and to really drive their point home, ACA should have said Boris is morally right in flouting what they refer to as an immoral US law.

Boris Johnson becoming compliant then renouncing would sent the most effective message to the American public and lawmakers, that some people would pay anything not to be American under current law as it stands. Otherwise he’s just a ‘scofflaw’ to most.

The following is a direct report from this article, and reflects the typical feeling and response of a dual national United States citizen who has spent virtually no time living in the United States, yet is required to pay taxes. This is largely a policy question and many have argued law must change; see, Co-author. “Tax Simplification: The Need for Consistent Tax Treatment of All Individuals (Citizens, Lawful Permanent Residents and Non-Citizens Regardless of Immigration Status) Residing Overseas, Including the Repeal of U.S. Citizenship Based Taxation,” by Patrick W. Martin and Professor Reuven Avi-Yonah, September 2013.-

http://thedianerehmshow.org/au...

Directly from article-

The prospective Conservative Parliamentary candidate, who was born in New York and holds a US passport, revealed his dispute with the US Treasury during an American radio phone-in while he was publicising his new book, The Churchill Factor.

His claims came after he was asked about renouncing his US citizenship, which the caller said was “very hard”, on National Public Radio.

Mr Johnson said: “I have to confess to you, that you’re right, it is a very – it is very hard, but I will say this, the great United States of America does have some pretty tough rules, you know.

“You may not believe this but if you’re an American citizen, America exercises this incredible doctrine of global taxation, so that even though tax rates in the UK are far higher and I’m Mayor of London, I pay all my tax in the UK and so I pay a much higher proportion of my income in tax than I would if I lived in America.

“The United States comes after me, would you believe it, for the – for capital gains tax on the sale of your first residence which is not taxable in Britain, but they’re trying to hit me with some bill, can you believe it?”

Presenter Susan Page then pressed him whether he would pay the bill, to which he said: “I think it’s outrageous.

“Well, I’m – no is the answer. Why should I? I haven’t lived in the United States for, you know, well, since I was five years old.

“I could but I pay – I pay the lion’s share of my tax, I pay my taxes to the full in the United Kingdom where I live and work.”

Sunday, November 23, 2014

How the IRS “Non-Filer Program” Affects USCs and LPRs Residing Outside the U.S.

U.S. citizens who have spent most all of their lives outside the U.S.

are often times shocked to learn about the scope of the U.S.

citizenship based taxation system. In recent years, due to the

aggressive pursuit of the IRS and Tax Division of the Department of

Justice, there has become a keen focus on assets and accounts located

outside the U.S.

Most recently in August of this year, the IRS has articulated its position for U.S. citizens and lawful permanent residents residing outside the U.S. in a document titled – “New Filing Compliance Procedures for Non-Resident U.S. Taxpayers“

The IRS has had for years a specific program for “non-filers”; i.e., those persons who do not file U.S. income tax returns. The program is detailed in the Internal Revenue Manual, set out below.

Most recently in August of this year, the IRS has articulated its position for U.S. citizens and lawful permanent residents residing outside the U.S. in a document titled – “New Filing Compliance Procedures for Non-Resident U.S. Taxpayers“

The IRS has had for years a specific program for “non-filers”; i.e., those persons who do not file U.S. income tax returns. The program is detailed in the Internal Revenue Manual, set out below.

- 4.19.17.1 Non-Filer Program

- 4.19.17.2 Non-Filer Strategy

- 4.19.17.3 Non-Filer Processing

- 4.19.17.4 Non-Filer Penalties

- 4.19.17.5 Undelivered Mail

- 4.19.17.6 Taxpayer Replies

- 4.19.17.7 Closures – Non Examined

Monday, November 17, 2014

Voluntary Disclosures by Homelanders who were Non-Filers

Practitioners often struggle with the issue of whether a taxpayer can avoid a criminal tax investigation by making a disclosure to the IRS. A "voluntary disclosure" generally involves the process of contacting the IRS in some manner and voluntarily reporting previously undisclosed income (or false deductions) through an amended return or the filing of a delinquent return. A taxpayer's timely, voluntary disclosure of a significant unreported tax liability is an important factor to the IRS in considering whether the matter should be referred to the U.S. Department of Justice for criminal prosecution. Properly resolving this issue can mean the difference between a taxpayer being criminally excused of a tax crime or being convicted on the basis of admissions derived from the voluntary disclosure itself.

Certainly, the IRS has a somewhat limited capacity to perform criminal investigations. However, a significant amount of time is not required to criminally investigate and prosecute a non-filer, particularly one who files delinquent or amended returns following an IRS inquiry. Without adequate representation, the perceived light at the other end of the voluntary disclosure tunnel . . . may be the IRS train coming straight at the taxpayer!

FOIA request on OVDP

Lets start with "non-willful" and "reasonable cause" are two different concepts.

It goes like this : If the evidence tends to show NW, then the examiner should shift the focus of the investigation to RC. The examiner should use the NW FBAR penalty mitigation guidelines only where there is no RC and should not assert NW FBAR penalties if he finds RC for the violation and the taxpayer files correct FBARs.

First test would be

a) NW criterias:

1. only signature authority over the "foreign" bank account

2. did not participate in an abusive tax avoidance scheme

3. tax compliance

4. relied upon the advice of a CPA

5. full compliance after notification of FBAR reporting requirements

6. "Foreign" account disclosed to return preparer

7. person owns the account in his name

8. business reason for the "foreign" account

9. family or business connection to the foreign country

10. no previously-filed FBARs

11. no illegal income in the "foreign" account

afterwards 2nd test with regards to

b) RC criterias :

1. person opened the account for a legitimate purpose (lived in the foreign country at the time)

2. person did not use the account for tax evasion

3. person relied on the advice of a qualified CPA

4. person complied with the tax laws of the country of residence by reporting all taxable income and paying the correct amount of tax

5. person reported all income from the undisclosed "foreign account" (not possible for NF)

6. person has only a De minimus US tax deficiency as a result of the undisclosed "foreign account"

7. person filed promptly delinquent FBARs after becoming aware of his obligation and timely subsequent FBARs.

It goes like this : If the evidence tends to show NW, then the examiner should shift the focus of the investigation to RC. The examiner should use the NW FBAR penalty mitigation guidelines only where there is no RC and should not assert NW FBAR penalties if he finds RC for the violation and the taxpayer files correct FBARs.

First test would be

a) NW criterias:

1. only signature authority over the "foreign" bank account

2. did not participate in an abusive tax avoidance scheme

3. tax compliance

4. relied upon the advice of a CPA

5. full compliance after notification of FBAR reporting requirements

6. "Foreign" account disclosed to return preparer

7. person owns the account in his name

8. business reason for the "foreign" account

9. family or business connection to the foreign country

10. no previously-filed FBARs

11. no illegal income in the "foreign" account

afterwards 2nd test with regards to

b) RC criterias :

1. person opened the account for a legitimate purpose (lived in the foreign country at the time)

2. person did not use the account for tax evasion

3. person relied on the advice of a qualified CPA

4. person complied with the tax laws of the country of residence by reporting all taxable income and paying the correct amount of tax

5. person reported all income from the undisclosed "foreign account" (not possible for NF)

6. person has only a De minimus US tax deficiency as a result of the undisclosed "foreign account"

7. person filed promptly delinquent FBARs after becoming aware of his obligation and timely subsequent FBARs.

Prepare for an Offshore IRS Audit

Don’t be a snitch!

Never volunteer information in an IRS audit and this goes double in an

offshore IRS audit. The agent is NOT your friend. He’s there to find

errors and extract a penalty for those mistakes. While you must always

be honest, only answer questions that are asked. Never volunteer new

information or expand on a subject beyond the question. You might think

you are helping, but you’re just making things worse.

The same goes for documents. Never give more paper than is requested.

You might think it shows good faith, and you’d be wrong again. More

documentation just gives them more ammunition. More chances to find an

error or a discrepancy.

Review your bank statements.

Go through your bank statements and understand each and every deposit.

Those that are income should be identified as such. Those that are

nontaxable, such as loans and gifts, should have supporting documents.

The first line of attack in an offshore IRS audit is the bank statement,

so be ready to prove up all nontaxable items.

Remember that, so long as you are a U.S. citizen, the IRS has a right

to audit your offshore company and international business activities.

Therefore, you must maintain records of income and expenses for offshore

transactions just as you would for a U.S. based business.

Warren Buffett is again showing President Obama how to use the U.S. tax code to his advantage.

Buffett Seen Saving More than $1 Billion in Taxes with P&G Swap

For the third time in a year, the billionaire chairman of Berkshire Hathaway Inc. has structured a deal in which he buys businesses in exchange for stock that has appreciated. The transactions, called cash-rich split-offs, allow him to avoid capital gains taxes that would be incurred if he sold the shares in the open market.

Berkshire announced Thursday that it would turn over about $4.7 billion in Procter & Gamble Co. stock in exchange for P&G’s Duracell battery business, which will be infused with about $1.7 billion in cash.

Since Buffett’s cost basis on the shares was about $336 million, and corporate capital gains are typically taxed at 35 percent, structuring the deal in this way could save Berkshire more than $1 billion. P&G also stands to reduce its tax liability on the sale.

“Cutting out the 35 percent capital gains allows them to do this at a price that’s more attractive for Berkshire,” said Richard Cook, co-founder of Cook & Bynum Capital Management LLC, which holds shares in Buffett’s company. “If they did it in an open auction, P&G would probably wind up in a similar position, and Berkshire wouldn’t have participated.”

The Duracell deal mirrors two of Buffett’s transactions this year. In February, Berkshire handed over a holding in Phillips 66 in exchange for its pipeline-flow-improver business. He later swapped a stake in Graham Holdings Co. for cash, a Miami television station and Berkshire stock that Graham held. Graham is the former publisher of the Washington Post.

Berkshire highlighted the attractive nature of the deals in its latest quarterly report to the U.S. Securities and Exchange Commission.

For the third time in a year, the billionaire chairman of Berkshire Hathaway Inc. has structured a deal in which he buys businesses in exchange for stock that has appreciated. The transactions, called cash-rich split-offs, allow him to avoid capital gains taxes that would be incurred if he sold the shares in the open market.

Berkshire announced Thursday that it would turn over about $4.7 billion in Procter & Gamble Co. stock in exchange for P&G’s Duracell battery business, which will be infused with about $1.7 billion in cash.

Since Buffett’s cost basis on the shares was about $336 million, and corporate capital gains are typically taxed at 35 percent, structuring the deal in this way could save Berkshire more than $1 billion. P&G also stands to reduce its tax liability on the sale.

“Cutting out the 35 percent capital gains allows them to do this at a price that’s more attractive for Berkshire,” said Richard Cook, co-founder of Cook & Bynum Capital Management LLC, which holds shares in Buffett’s company. “If they did it in an open auction, P&G would probably wind up in a similar position, and Berkshire wouldn’t have participated.”

The Duracell deal mirrors two of Buffett’s transactions this year. In February, Berkshire handed over a holding in Phillips 66 in exchange for its pipeline-flow-improver business. He later swapped a stake in Graham Holdings Co. for cash, a Miami television station and Berkshire stock that Graham held. Graham is the former publisher of the Washington Post.

Berkshire highlighted the attractive nature of the deals in its latest quarterly report to the U.S. Securities and Exchange Commission.

Sunday, November 16, 2014

The 2015 filing season will be the worst filing season in over 25 years when even 1040 income tax returns disappeared...........

The IRS National Taxpayer Advocate Nina Olson predicts:

“…..The

filing season is going to be the worst filing season since I’ve been

the national taxpayer advocate; I’d love to be proved wrong, but I think

it will rival the 1985 filing season when returns disappeared,” she

told the audience of tax practitioners, according to Forbes…..”

And for those outside the US who try to be ‘compliant’?

“……It

will be even worse for those filing outside the US. “If they are

overseas, who are they going to call? There is not toll free number,”

Olson noted……”

So

much for all those ‘services’ and ‘rights’ US extraterritorial tax

apologists like to cite to justify US taxation forced on the rest of the

world based on accidental US birthplace or parentage. Some of those

making those claims include US homelanders who’ve left the homeland nest

temporarily in order to come up here and strike it rich in the

goldfields of crossborder taxation – mining the local assets of many expats being extorted by the US. According to some of these homeland

opportunists recently; “… US citizens are afforded many privileges and

have access to benefits that non-citizens do not enjoy, including

protection abroad, consular services, the right to vote, and easy access

to the US job market…. “.

Yes sure. But can they get the IRS on the phone? The Taxpayer Advocate says not.

And we have a firsthand account of a consular official in Canada

stating that certain ‘consular services’ and exercising the right of a

US citizen to renounce – sought by those in Canada are of ‘low priority’

and are going to stay that way – even when those US citizens pay 2350.

USD for the privilege of the ‘service’ that is their legal right. Many

can’t ever vote in the US from Canada because they have never lived in

the US, never lived there long enough, or didn’t have a US parent who

would have qualified. Over half the US states do not allow absentee

registration and voting from abroad without a minimum period of US

residency – even some of those who may have had a US parent who at some

point resided in a US state, are subject to rules about the voting

eligibility or residency of the US parent http://www.fvap.gov/citizen-voter/reside .

And

as for ‘protection abroad’? Oh yeah, that must be the US drones and US

Homeland security enforcers all set to operate on Canadian soil – but

demanding to be exempt from Canadian laws http://www.huffingtonpost.ca/2013/07/30/border-security-us-police-legal-exemptions_n_3678240.html . We need protection from them, not protection by them.

Saturday, November 15, 2014

Previously Unreleased IRS Guidelines for FBAR Audits

- Offshore Voluntary Disclosure Workshop Houston,TX 09/11

- Offshore Voluntary Disclosure Workshop Chicago, IL 09/12

- FBAR Report of Foreign Bank and Financial Accounts

- Offshore Voluntary Disclosure Program Quick Start Guide

- Voluntary Disclosure Program(VDP) Job Aid use in Interpreting XXX Statements April 2010

- E-trak VDP Voluntary Disclosure Database Access Via Form 5081

- International Technical Training(Instructor Guide)

- International Technical Training(Participant Guide)

- Recorded Session: Basic Structures Part 1: Basic Structures Used to Conceal Beneficial Ownership of Foreign Financial Accounts and Other Assets

- Recorded Session: Basic Structures Part 2: Pre-Audit, Investigative Techniques & Statutes

- Recorded Session: Basic Structures Part 3: Interviewing and International Penalties

- IIC e-Town Hall Tax Compliance Officers Updates and Technical Issues

- Recorded Session: Overview of Subpart F Income

- Recorded Session: Application of Treaties

Thursday, November 13, 2014

Not only is the Department of Justice getting desperate with finding and convicting alleged guilty Swiss Bankers - now a New York Federal Prosecutor is joining the race

New York federal prosecutors said on Thursday that they indicted a

former Rahn & Bodmer Co. executive for allegedly helping some of the

Swiss bank’s clients hide hundreds of millions of dollars in assets

from the Internal Revenue Service.

Martin Dunki allegedly conspired with his clients for more than a decade to help them evade taxes, creating a series of sham foundations chartered in foreign countries and following the announced federal investigation into UBS AG, used his clients assets to buy gold to further conceal the activities.

Martin Dunki, who retired from the bank in 2012, was charged with one count of conspiracy in an indictment filed in federal court in New York. The bank was not named in court papers, but was described as purporting to be the oldest private bank in Zurich, a description that Rahn & Bodmer uses on its website.

"Martin Dunki went to great lengths to help his U.S. taxpayer clients secret away millions of dollars in Swiss bank accounts," Manhattan U.S. Attorney Preet Bharara said in a statement.

Dunki, 66, who lives in Switzerland, has not been arrested and has no known lawyer, according to U.S. prosecutors.

Camellia Plc, where Dunki is a non-executive director, did not reply to emails seeking comment from the defendant.

Rahn & Bodmer, which was established in 1750 and has 12 billion Swiss francs ($12.45 billion) under management, confirmed in September 2013 that it was under investigation. It did not respond to a request for comment on Thursday after normal business hours.

Earlier this month, Raoul Weil, who once led UBS AG's global wealth management unit, was acquitted on charges of conspiring to help Americans hide $20 billion in offshore accounts.

U.S. prosecutors said Dunki led a similar conspiracy at Rahn & Bodmer from 1995 to 2012, helping Americans hide hundreds of millions of dollars in undeclared accounts. One taxpayer hid nearly $300 million with Dunki's help, prosecutors said.

Starting in 1999, Dunki, Zurich-based lawyer Edgar Paltzer and an unidentified lawyer in Santa Barbara, California, began working together to manage undeclared accounts at Rahn & Bodmer, prosecutors said.

Paltzer, a dual U.S.-Swiss citizen, pleaded guilty in August 2013 to conspiracy and agreed to cooperate with U.S. authorities.

"Mr. Paltzer continues to cooperate with the U.S. Attorney's office," said Thomas Ostrander, a lawyer with the firm Duane Morris who represents Paltzer, without commenting on the substance of Thursday's indictment.

Martin Dunki allegedly conspired with his clients for more than a decade to help them evade taxes, creating a series of sham foundations chartered in foreign countries and following the announced federal investigation into UBS AG, used his clients assets to buy gold to further conceal the activities.

Martin Dunki, who retired from the bank in 2012, was charged with one count of conspiracy in an indictment filed in federal court in New York. The bank was not named in court papers, but was described as purporting to be the oldest private bank in Zurich, a description that Rahn & Bodmer uses on its website.

"Martin Dunki went to great lengths to help his U.S. taxpayer clients secret away millions of dollars in Swiss bank accounts," Manhattan U.S. Attorney Preet Bharara said in a statement.

Dunki, 66, who lives in Switzerland, has not been arrested and has no known lawyer, according to U.S. prosecutors.

Camellia Plc, where Dunki is a non-executive director, did not reply to emails seeking comment from the defendant.

Rahn & Bodmer, which was established in 1750 and has 12 billion Swiss francs ($12.45 billion) under management, confirmed in September 2013 that it was under investigation. It did not respond to a request for comment on Thursday after normal business hours.

Earlier this month, Raoul Weil, who once led UBS AG's global wealth management unit, was acquitted on charges of conspiring to help Americans hide $20 billion in offshore accounts.

U.S. prosecutors said Dunki led a similar conspiracy at Rahn & Bodmer from 1995 to 2012, helping Americans hide hundreds of millions of dollars in undeclared accounts. One taxpayer hid nearly $300 million with Dunki's help, prosecutors said.

Starting in 1999, Dunki, Zurich-based lawyer Edgar Paltzer and an unidentified lawyer in Santa Barbara, California, began working together to manage undeclared accounts at Rahn & Bodmer, prosecutors said.

Paltzer, a dual U.S.-Swiss citizen, pleaded guilty in August 2013 to conspiracy and agreed to cooperate with U.S. authorities.

"Mr. Paltzer continues to cooperate with the U.S. Attorney's office," said Thomas Ostrander, a lawyer with the firm Duane Morris who represents Paltzer, without commenting on the substance of Thursday's indictment.

Expats : application of the mandatory health insurance requirement

The Affordable Care Act (also known as Obamacare, will be referred to as

ACA in the remaining of this post) mandates that everybody buys health

insurance. I’m not sure exact as to what happened, possibly congress

assumed the law only applied to US residents but never actually spelled

it out in the law. By anybody, I mean anybody, IRC 500A refers to an “applicable individual”,

which is any individual except those who are not required to have

health insurance by virtue of IRC 5000A(d)(2) thru (4) – it seems that a

swiss citizen living in Switzerland would be exempt from the mandate under

“(3) Individuals not lawfully present” but this paragraph specifically

excludes US citizens.

Tax Preparer Pleads Guilty to Running Ponzi Scheme

A tax preparer in the Bronx, N.Y., has pleaded guilty to operating a $4.8 million Ponzi scheme and faces up to 11 years in prison.

Robert H. "Bob" Van Zandt pleaded guilty Monday to a 33-count indictment lodged against him, including securities fraud and grand larceny. In exchange for his plea, Justice Martin Marcus agreed to sentence Van Zandt to between three and two-thirds to 11 years in prison.

Securities fraud is a serious crime which my office will prosecute to the fullest extent of the law," New York State Attorney General Eric Schneiderman said in a statement Tuesday. “Mr. Van Zandt stole his victims’ life savings, forcing some of them to re-enter the workplace after their retirement and others to rely on government assistance to survive. The perpetrators of this and other Ponzi schemes will face justice.”

see also : oops....forex investors may face a $1 billion loss as trading site Secure Investment vanishes. http://bloom.bg/1GS3qdG

Wednesday, November 12, 2014

The Impact of FATCA and why it turns bank tellers at foreign institutions into unpaid IRS agents

Some new meme needs to overtake Schumer's and Levin's and Bill Nelson's and Barbara Boxer's smearing of US persons abroad. The message should not be to tell the World that all expats, immigrants and green card holders are all Tax Evaders. Go find them ! Go FATCA them ! Go FBAR them !

As the administration and friends were looking for someone else to fund both their deficit and their new domestic jobs bills (such as 2010 HR 2847 Jobs for Mainstreet Act), they looked around for new ways to get money from people they didn’t like. However, they needed to get it from people who couldn’t fight back. They also needed to make sure that no one else would come in and defend those people. FATCA is founded in a U.S. tax code that attacks small business and lavishes tax holidays on the wealthy (tax inversions, for example). It came about because America is the only large economy which taxes its citizens on their worldwide income. The US is the only country that forces our citizens abroad, including those who are residents of another country, to pay tax at home.

As the administration and friends were looking for someone else to fund both their deficit and their new domestic jobs bills (such as 2010 HR 2847 Jobs for Mainstreet Act), they looked around for new ways to get money from people they didn’t like. However, they needed to get it from people who couldn’t fight back. They also needed to make sure that no one else would come in and defend those people. FATCA is founded in a U.S. tax code that attacks small business and lavishes tax holidays on the wealthy (tax inversions, for example). It came about because America is the only large economy which taxes its citizens on their worldwide income. The US is the only country that forces our citizens abroad, including those who are residents of another country, to pay tax at home.

“What is the largest segment of US citizens that can’t fight back? There are 7.6 million US citizens living outside the USA, and we make it difficult for them to vote–as difficult as we can, that is”.

Into this system comes FATCA. It basically turns bank tellers at

foreign institutions in to unpaid IRS agents. The first impact of FATCA

is to require all foreign banks to determine which of its clients are

U.S. persons and to report all of their transactions to the IRS.

Tuesday, November 11, 2014

TAXPAT : punishing people for leaving, instead of rewarding people for staying.

It’s official. Obama has achieved the ominous distinction of becoming

the first U.S. president to have had more than 10,000 very wealthy

taxpayers renounce their U.S. citizenship under his watch.

It’s official. Obama has achieved the ominous distinction of becoming

the first U.S. president to have had more than 10,000 very wealthy

taxpayers renounce their U.S. citizenship under his watch.1. 10-year expatriation tax (1996) (H.R. 3103 – 104th)

2. American Jobs Creation Act (2004) (H.R. 4520 – 108th)

3. US Exit tax (2008)

Think about it. If each law they pass is progressively more punitive, what message is that sending? It’s telling the people at whom those laws are aimed (the rich), that you should get out, before it gets worse.

According to the combined “Quarterly Publication of Individuals, Who Have Chosen To Expatriate” reports published in the Federal Register, since Obama assumed office the exact number of so-called, “covered expatriates,” on September 30, 2014, was 10,413.

It is important to emphasize that these lists represent only wealthy expatriates. Under covered expatriate is is any expatriate who had a net worth of at least $2,000,000 (in current dollars) on the date of expatriation or had incurred a tax liability of net $157,000 per year (based on 2014 dollars and adjusted annually) in each of the 5 years prior to expatriation. The IRS reports that the top 1% of income earners pay income tax at an average rate of 23.5%. So using that tax rate, an individual with such a tax liability would have to earn in the vicinity of $668,000 per year or roughly double the income floor to be in the top 1% of income earners.

When the rich leave, it causes a disproportionate loss of tax revenue, that must be made up by those of us who remain. Since the rich are most often job creators, it also means that many of the jobs that they create will move offshore, as well. According to the latest IRS Collections Data, the top 1% of income earners pay 35.06% of all personal income tax collected in the USA. Based on that figure, if all of the top 1% of income earners were to leave the USA, the government would have to increase taxes on the rest of us by roughly 54%, just to stay even and that’s before considering the lost jobs that would go along with it. Look back up at the chart at the top of this page and consider that these numbers represent just those wealthy expats in the top 1%, who formally renounced. Then consider that many more, such as Tina Turner, lose their citizenship through “relinquishment,” which is not recorded on these lists. There are also others, who choose the "PT" route, who just effectively drop off the financial radar of the USA, without renouncing. It’s only reasonable to assume that other forms of expatriation are increasing at rates similar to formal renunciations. So, at the rate formal renunciations of this income group are increasing, this could be just the beginnings of an economic disaster.

Expats don’t see themselves as fleeing the USA, but rather, as fleeing a government that has become hostile to the the principles upon which this nation was founded. They’re fleeing an IRS that makes up its own rules as it goes along. They’re fleeing a government that has forgotten due process. The only thing that will stop this flight of wealth is a return to a smaller, responsible, representative government that doesn’t punish success.

http://fairtax.org/

Monday, November 10, 2014

Wow, finally somebody who nearly correctly reports the facts !

FBAR Penalties

This past year the government brought a case against Carl R. Zwerner of Miami for willful failure to file foreign bank account reports. The penalties were originally assessed at 4x50% willful penalty or 3 times the value of the undisclosed account that Mr. Zwerner held offshore. The case was taken to trial, and the jury found for the government for about 150% (3x50% willful penalty) of the value of the account. The jury was also asked to decide whether the FBAR penalties were constitutional under the Eighth Amendment. On the eve of a hearing on the issue, the case was settled and Mr. Zwerner agreed to pay 100% (2x50% willful penalty) of the value of the account.

The case shows that the government won't be a "shrinking violet" in bringing similar judicial action, said Michel.

The case will likely raise government concerns about the Constitution argument, because in light of existing case law it is hard to imagine that a similar case wouldn't raise judges' eyebrows when a penalty exceeds the value of the taxpayer's assets, said Michel.

http://www.capdale.com/scott-michel-comments-on-us-strengthening-international-tax-enforcement-efforts

This past year the government brought a case against Carl R. Zwerner of Miami for willful failure to file foreign bank account reports. The penalties were originally assessed at 4x50% willful penalty or 3 times the value of the undisclosed account that Mr. Zwerner held offshore. The case was taken to trial, and the jury found for the government for about 150% (3x50% willful penalty) of the value of the account. The jury was also asked to decide whether the FBAR penalties were constitutional under the Eighth Amendment. On the eve of a hearing on the issue, the case was settled and Mr. Zwerner agreed to pay 100% (2x50% willful penalty) of the value of the account.

The case shows that the government won't be a "shrinking violet" in bringing similar judicial action, said Michel.

The case will likely raise government concerns about the Constitution argument, because in light of existing case law it is hard to imagine that a similar case wouldn't raise judges' eyebrows when a penalty exceeds the value of the taxpayer's assets, said Michel.

http://www.capdale.com/scott-michel-comments-on-us-strengthening-international-tax-enforcement-efforts

Do you need to put up with the consequences of unknowledgeable CPAs ?

CPA’s and other professional tax return preparers are bound to the IRS Code Of Professional Responsibility commonly called Circular 230 which if a tax preparer violates could lead to big penalties and sanctions for that tax preparer. Internal Revenue Code § 6694(a) provides that if any part of an understatement of a taxpayer’s liability is due to an “unrealistic position” taken on his return, any income tax return preparer who knew (or reasonably should have known) of this position is subject to a penalty of $250. If the understatement is due to a reckless or intentional disregard of rules or regulations the penalty is $1,000 per occurrence.

The tax preparer’s employer, firm or entity also is subject to the penalty if it knew, or reasonably should have known, of the conduct giving rise to the penalty.

The tax preparer’s employer, firm or entity also is subject to the penalty if it knew, or reasonably should have known, of the conduct giving rise to the penalty.

USCs and LPRs Who Are Having Their Non-U.S. Accounts Closed: Is it hype or is it real?

1. Wall

Street Journal: Expats Left Frustrated as Banks Cut Services Abroad

Americans Overseas Struggle With Implications of Crackdown on Money

Laundering and Tax Evasion (11 Sept 2014)

2. Wall Street Journal – Opinion (Colleen Graffy): How to Lose Friends, Citizens and Influence; The U.S. Foreign Account Tax Compliance Act seeks to co-opt foreign banks as long-arm enforcement

3. Association of Americans Resident Overseas: Americans Abroad are Denied Access to Banking and Investment Opportunities

4. Time Magazine: Swiss Banks Tell American Expats to Empty Their Accounts

5. The Huffington Post (Aug 2014) – Expatriate Tax Sense or Broad-Brush Overreach: The U.S. Foreign Account Tax Compliance Act (FATCA)

6. The New York Times (April 2013) Overseas Finances Can Trip Up Americans Abroad

7. American Citizens Abroad which compiles various news accounts of accounts being closed.

For good practical advice about maintaining or opening foreign accounts, I recommend you read:

2. Wall Street Journal – Opinion (Colleen Graffy): How to Lose Friends, Citizens and Influence; The U.S. Foreign Account Tax Compliance Act seeks to co-opt foreign banks as long-arm enforcement

3. Association of Americans Resident Overseas: Americans Abroad are Denied Access to Banking and Investment Opportunities

4. Time Magazine: Swiss Banks Tell American Expats to Empty Their Accounts

5. The Huffington Post (Aug 2014) – Expatriate Tax Sense or Broad-Brush Overreach: The U.S. Foreign Account Tax Compliance Act (FATCA)

6. The New York Times (April 2013) Overseas Finances Can Trip Up Americans Abroad

7. American Citizens Abroad which compiles various news accounts of accounts being closed.

For good practical advice about maintaining or opening foreign accounts, I recommend you read:

American Citizens Abroad: Maintaining Bank Accounts in the United States While You Are Living Abroad – Recommended

steps for overseas Americans to follow if a U.S. bank refuses either

to open an account or to maintain an account because of the client’s

foreign address

How the IRS Can file a “Substitute Return” for those USCs and LPRs Residing Overseas

The U.S. federal government has extensive “legal tools” at their

disposal to help enforce the U.S. tax law overseas. There are limits,

both in practice and legally, of how they can effectively use those

legal tools against USCs and LPRs residing outside the U.S. Although U.S. citizenship taxation has been the law in the U.S. since

the Civil War, it has been a “de facto” residency based taxation system

for the last 100 years, since the U.S. government did not have the means

to collect information to identify assets, income and USC and LPR

taxpayers outside the U.S. Plus, based upon my experience, few USCs who

lived almost all of their lives outside the U.S. had any idea of their

obligation to file U.S. federal income tax returns, as U.S. “tax

residents.” IRS Form 1040.

This has changed with technology, the integrated worldwide financial system and FATCA which is now bringing a massive amount of financial data and information to the IRS. See also New York Times Article from Feb. 2012, If You Don’t File, Beware the Ghost Return .

This has changed with technology, the integrated worldwide financial system and FATCA which is now bringing a massive amount of financial data and information to the IRS. See also New York Times Article from Feb. 2012, If You Don’t File, Beware the Ghost Return .

8 Tax Facts for Deducting Charitable Contributions but not for EXPATS

1. You must donate to a qualified charity if you want to deduct the gift. You can’t deduct gifts to individuals, political organizations or candidates.

2. In order for you to deduct your contributions, you must file Form 1040 and itemize deductions. File Schedule A, Itemized Deductions, with your federal tax return.

3. If you get a benefit in return for your contribution, your deduction is limited. You can only deduct the amount of your gift that’s more than the value of what you got in return. Examples of such benefits include merchandise, meals, tickets to an event or other goods and services.

4. If you give property instead of cash, the deduction is usually that item’s fair market value. Fair market value is generally the price you would get if you sold the property on the open market.

5. Used clothing and household items generally must be in good condition to be deductible. Special rules apply to vehicle donations.

6. You must file Form 8283, Noncash Charitable Contributions, if your deduction for all noncash gifts is more than $500 for the year.

7. You must keep records to prove the amount of the contributions you make during the year. The kind of records you must keep depends on the amount and type of your donation. For example, you must have a written record of any cash you donate, regardless of the amount, in order to claim a deduction. It can be a cancelled check, a letter from the organization, or a bank or payroll statement. It should include the name of the charity, the date and the amount donated. A cell phone bill meets this requirement for text donations if it shows this same information.

8. To claim a deduction for donated cash or property of $250 or more, you must have a written statement from the organization. It must show the amount of the donation and a description of any property given. It must also say whether the organization provided any goods or services in exchange for the gift.

2. In order for you to deduct your contributions, you must file Form 1040 and itemize deductions. File Schedule A, Itemized Deductions, with your federal tax return.

3. If you get a benefit in return for your contribution, your deduction is limited. You can only deduct the amount of your gift that’s more than the value of what you got in return. Examples of such benefits include merchandise, meals, tickets to an event or other goods and services.

4. If you give property instead of cash, the deduction is usually that item’s fair market value. Fair market value is generally the price you would get if you sold the property on the open market.

5. Used clothing and household items generally must be in good condition to be deductible. Special rules apply to vehicle donations.

6. You must file Form 8283, Noncash Charitable Contributions, if your deduction for all noncash gifts is more than $500 for the year.

7. You must keep records to prove the amount of the contributions you make during the year. The kind of records you must keep depends on the amount and type of your donation. For example, you must have a written record of any cash you donate, regardless of the amount, in order to claim a deduction. It can be a cancelled check, a letter from the organization, or a bank or payroll statement. It should include the name of the charity, the date and the amount donated. A cell phone bill meets this requirement for text donations if it shows this same information.

8. To claim a deduction for donated cash or property of $250 or more, you must have a written statement from the organization. It must show the amount of the donation and a description of any property given. It must also say whether the organization provided any goods or services in exchange for the gift.

Sunday, November 9, 2014

IRS on Quiet Filings for Offshore Account Delinquencies or Underreporting

Tax Notes Today reports the following on quiet disclosures (Amy S. Elliott, IRS Working With SSA on Offshore Streamlined Filing Requirement, 2014 TNT 216-3 (11/7/14)

Remember it is the law you have to file but there is no law that says you have to enter one of the IRS programs. Even though the IRS is pretty disorganized, I doubt it’s an accident that the Fact Sheet is still up on the IRS web site. I take that to mean a QD is still considered a perfectly viable way to fix things.

Link to the 2011-13 IRS Fact Sheet :

http://www.irs.gov/uac/Newsroom/Information-for-U.S.-Citizens-or-Dual-Citizens-Residing-Outside-the-U.S.

Regarding so-called quiet disclosures -- when taxpayers file amended returns and delinquent foreign bank account reports without coming in through the offshore voluntary disclosure program or the streamlined program -- Best [senior adviser to the deputy commissioner (international), IRS Large Business and International Division] said, "The IRS recognizes that a quiet filing is a choice that the taxpayer has." But Best added, "We would prefer that taxpayers come in through one of our programs so that we have tracking mechanisms, information gathering mechanisms set up, but ultimately it's up to the taxpayer."

It is good to hear an IRS representative reported to have present quiet disclosures as an option without, apparently, saying stronger words of discouragement this is certainly a change of tone compared to the past.

Remember it is the law you have to file but there is no law that says you have to enter one of the IRS programs. Even though the IRS is pretty disorganized, I doubt it’s an accident that the Fact Sheet is still up on the IRS web site. I take that to mean a QD is still considered a perfectly viable way to fix things.

Link to the 2011-13 IRS Fact Sheet :

http://www.irs.gov/uac/Newsroom/Information-for-U.S.-Citizens-or-Dual-Citizens-Residing-Outside-the-U.S.

Growing Use of IRS Civil Forfeitures Creates Nightmares for Small Business Owners Or How Your Constitutional Guarantee Of Innocence Until Proven Guilty Has Been Completely Reversed

Civil forfeiture as it exists today has no place in the American legal

system, where citizens are innocent until proven guilty and granted due

process to prove their innocence. People subject to civil forfeiture are

powerless against law enforcement agencies who gain from these takings.

Common sense instead of overreach again would go a long way !! The IRS

should not simply assume that every case that looks like it might

involve structuring actually does involve structuring or also known as

smurfing in banking industry jargon . I just do not understand what the

big deal is. If there is a smidgen of suspicion just audit the person

immediately to see if anything illegal transpired.

This simple solution is as good or as bad as the current one where the government seems to be incapable of following 18 U.S.C. § 983(a)(1) under CAFRA…60 day window or process 18 U.S.C. 983(a)(2)(A) – the right to file a claim for the return of their property where the IRS would have 90 days to either file a forfeiture action against the property—or return it.