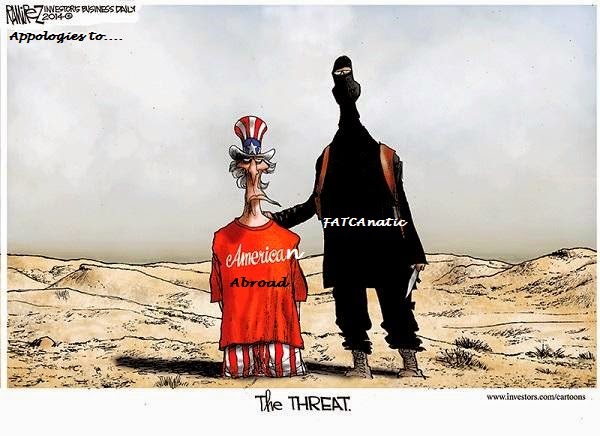

FATCA Legal Action is fighting to protect the constitutional rights of 7.6 million overseas Americans, 12.6 million Green card holders and American businesses abroad. The US stoutly defends its unique citizenship-based taxation system in an residence-based taxation world. Frankly there is a certain insanity in the US position on this that says it's the rest of the world that needs to change and not the US. All I can say is, "Good luck with that."

https://fatcalegalaction.com/

Logically, there’s also not much of an argument for global taxation. OK, yes, most people born and raised here were educated and provided various services by the government to get them to adulthood. But we’re overwhelmingly the largest net recipient of immigrants, and most of those people were educated and provided various services by their governments to get them to adulthood; we don’t seem to think there’s a problem with us free-riding on all those other nations. And surely there’s a statute of limitation on what you owe the government that raised you - 40 years later, should those expats still have to file insanely complicated returns to the IRS? Because that’s what we currently demand.

Most people seem to be under the misimpression that companies that invert, or people who renounce their citizenship, are doing so to get a lower tax rate on income they earn here. And in a few intellectual-property-based businesses, which can make aggressive use of transfer pricing strategies to declare most of their income in low- or no-tax countries, these complaints have some basis. In most cases, however, including Burger King, they’re doing it because the U.S. inexplicably insists on taking a big chunk off the top of all their foreign income, and making their lives miserable in the process.

If we’re worried about inversion, then the U.S. government should follow the lead of other developed countries, and move to territorial taxation. Otherwise, we should stop complaining when people and corporations decide that they’d rather be a citizen of some more sane system somewhere else.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.